Congratulations on thinking about how to invest your money at an early age. I have tried various investing strategies to make money, such as investing in domains, websites, and of course, the stock markets.

I believe the best strategy one can follow is to invest money in stock markets. The only caveat, you need money to start investing. And if you can only invest a small amount, you need to keep investing monthly for a long time.

I think financial knowledge is necessary to start investing in the stock market, but that can be learned, isn’t it? You need to first understand about stock markets, and the best way is to gain knowledge by reading several books like the Intelligent Investor. Don’t rush yourself in the markets without fully understanding how the stock market works.

Consider the importance of investing in markets early:

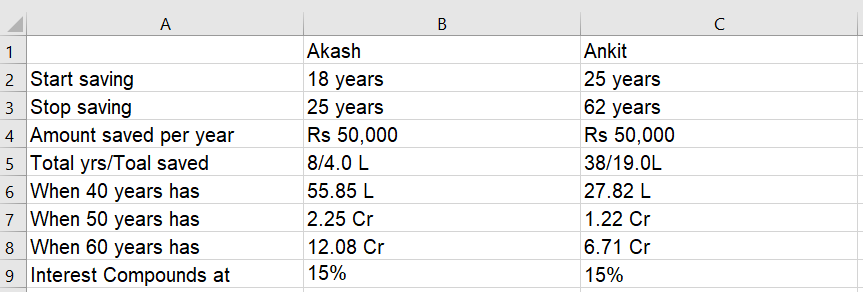

Let’s say there are two brothers Akash and Ankit:

Now see the advantage of investing earning. Compounding can make you rich, and the above example proves this.

If you can save 10 L at 25 (by working extremely hard) and invest that money in the markets and double your money every three years (20% returns every year), then in the next 30 years, that 10L will become 100cr.

Although this might not be 100% accurate, but the goal is to make 2-4 Cr in 20-30 years of your career via the stock market, which I think is pretty doable.

It would be best if you bought shares of businesses that can double your money every three years. And you want to hear something great? There are more than 100 stocks that have done better than that.

Is it easy? No, making money is never easy! But again, this is doable, and by hard work (reading and researching), you can definitely achieve this.

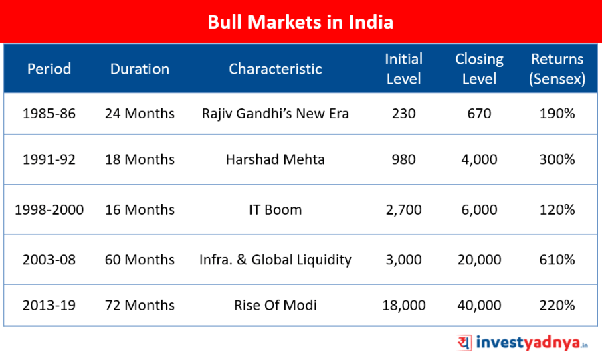

The greatest money is made when the bear market is over, and the bull market starts.

Did you see the returns by the Sensex? Again the above is achievable, and you just need two things:

- Patience

- Buying the Right Business

If you will truly invest in the business instead of the price fluctuation, then you would make money. You need to invest in the long-term and share the vision of the company and its promoters.

Don’t buy a good company at a high rate, meaning don’t overpay for the business, which can be a recipe for disaster. Good stock with great fundamentals should justify its price, and once all the parameters are checked, you should only invest in such businesses. Finding the right company is a lot of hard work as you need to read & analyze the company balance sheet, annual reports, etc.

Time – The friend of the great business

In short, have patience and invest in great companies early, invest for 10–15 years period, read everything you can about markets to gain knowledge.

Happy Investing.

Happening’s Around the Stock Market

- Interest cost for state loans (State Government Bonds) soars to 11-month high of 7.19%.

- FII and DII data for 22nd February: Foreign portfolio investors (FPIs) sold shares worth Rs 1,569 crore, while domestic institutional investors (DIIs) bough shares worth Rs 216 crore.

- NSE to make changes in index maintenance guidelines, read more about it here.

- The Big Bull Rakesh Jhunjhunwala sees Nifty at 90k-100K by 2030 (I share his views 😃) and wants to Ban Bitcoin. It’s always fun to read or watch his interviews.

- Sanjiv Bhasin positive on markets, says ‘buy the fear’.

Stock News

- Reliance Industries to spin off Oil-to-chemical (O2C) business into 100% Subsidiary with $25 billion loan.

- SC halts Future Group deal with Reliance on Amazon plea.

- CCI approves stake purchase in Tata Communications by Panatone Finvest.

- APL Apollo allots Rs 75 crore commercial paper to ICICI Prudential Ultra Short Term Fund.

- Jio Platforms set to invest $200 million in Kalaari Captial.

- Zuari Agro Chemicals to sell Goa fertiliser plant to Paradeep Phosphates for $280 million.

- Info Edge share rises after the Zomato raises $250 million. Info Edge holds a 19% stake in the food delivery giant Zomoato.

- Steel Strips Wheels has reduced the number of shares pledged to 41,11,994.

- DB Realty Board has approved fund raising through issue of issue of up to 4 crore convertible warrants.

- Indian Overseas Bank: Brickwork Ratings India assigned its rating of ‘BWR AA-/Stable’ for the proposed issue of Rs 500 crore Basel III Tier II bonds.

- UPL Limited said a fire broke out at the Gujarat Jagadia unit and is in shutdown condition.

- IRB Infra Board has approved the allotment of Unlisted, Unrated, Secured, Redeemable, Non- convertible Debentures aggregating to Rs2,184.55cr on a private placement basis.

- Alkem Labs, Ajanta Pharma and Sun Pharma received US FDA nod for generic of Northera.

- Bharat Forge bags Rs 178 crore order from Defence Ministry to supply of Kalyani M4 vehicles.

Important Global Updates

- Curde Oil at year-long highs as the coronavirus restrictions are easing.

- Bitcoin plummets $8,000 after Elon Musk’s concerns over rally.