You can’t really predict the day-to-day movement in the stock market. And that’s why everyone says, “You shouldn’t time the markets.”

Will the stocks go higher or lowers, or will the markets be pushed thousands of pointers lower, or will it open higher? Markets can move either way, and there are thousands of other possible scenarios.

However, the secret the long-term investors know is that it doesn’t really matter. You are not in the short-term game, and no matter what happens, a long-term investor is always the winner.

You must think I am must be kidding, so let’s take the example of BSE Sensex:

You can see the three red lines that I have marked in the BSE Sensex chart, from which it is evident that the markets always move above those lines. In fact, the Sensex moved from 5,000 levels to 20,000 and then to 40,000 levels. But this doesn’t happen overnight, or even in a year. It takes few years to cross the previous high for the Sensex.

Currently, the Sensex is at an all-time high of 50,000, and believe me, in the next 5-7 years, it will be 100,000. The average time it took Sensex to cross its previous highs is seven years. Now, if you invest only for five years, you may not be able to reap the benefits and you may think that long-term investing doesn’t work.

If you ask me, I think you should invest in the markets for at least a 10-year time frame and see the magic happen. But do note that you need to invest in fundamentally sound companies.

Fundamentally sound companies? They are companies with a good balance sheet that regularly post good results and have a healthy cash flow. Obviously, I can’t explain everything about finding good companies, but you get the gist.

Major Reasons Behind Sensex Falling Over 1,100 points Today

- Rising Covid cases in India

- Concerns over rising inflation

- Slow FPI inflow due to the above two factors

- Weak Global Cues

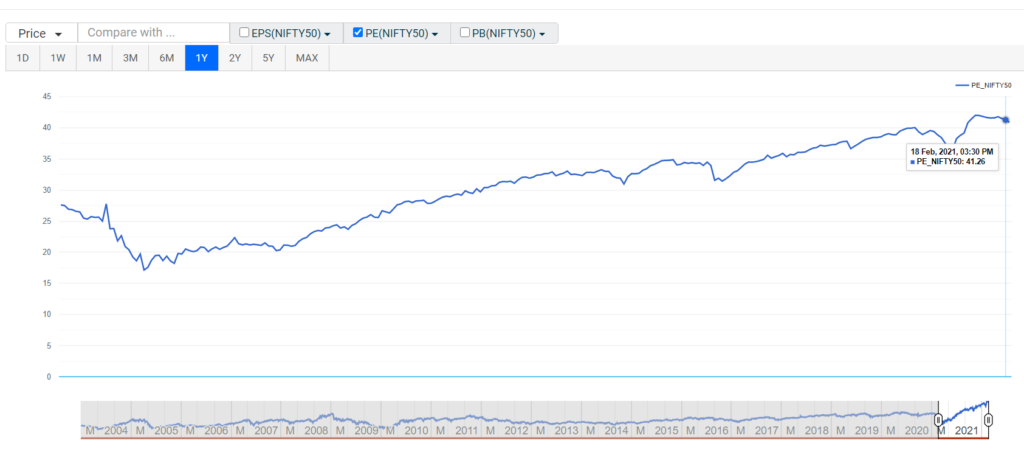

- Nifty50 P/E is at all-time high of 40

Happening’s Around the Stock Market:

- India VIX gained 3.07 percent to 25.32. The India VIX is a short form for the India Volatility Index, which measures the market’s expectation of volatility over the near term.

- FII and DII data for 19th February: Foreign portfolio investors (FPIs) bought shares worth Rs. 118.75 crore, while domestic institutional investors (DIIs) were net sellers to the tune of Rs. 1,174.98 crore.

- In the opening Trade today, the rupee opened on flat at 72.58 against the US dollar.

- Foreign institutional investors (FIIs) have invested Rs. 24,965 crore so far in February.

- What the hell went wrong with Franklin Templeton Fund? It all started with the Interference in Risk Management at Franklin Templeton. The Liquidity Issues in the Portfolios were highlighted much in advance at the board meetings. However, the board didn’t budge, and the issue was neglected. Macaulay Duration of Portfolios was miscalculated. The final nail in the coffin was the Inter Scheme Transfers (ISTs). ISTs were used for managing the liquidity of the schemes, which is an unfair practice because it impacts both the transferor scheme and the transferee scheme.

- Natural gas futures down 1.8% to Rs 212.50 per mmBtu on weak global cues.

Stocks in News

- Torrent Power gains over 14% today after the company emerges as the highest bidder for the Power distribution company in Dadra & Nagar Haveli.

- Tata Consumer completes 100% acquisition of Kottaram Agro Foods.

- Jet Airways shares hit 5% upper circuit after Murari Lal Jalan of Jalan-Kalrock consortium says Jet Airways will fly again by July-Aug after receiving approval from the NCLT for its resolution plan.

- RailTel IPO share allocation tomorrow, here is how you can check your allotment status.

- Thomas Cook plan to raise up to Rs 450 crore via issue of Optionally Convertible Cumulative Redeemable Preference shares (OCCRPS) through private placement.

- Supreme Court has allowed National Company Law Tribunal (NCLT) to proceed with the hearing of the Amazon vs Future Group case but restrains it from passing final orders.

- Jubilant FoodWorks shares up 5.21% on acquiring full control of Netherlands-based Fides Food Systems Coöperatief UA for $35 million.

- ICRA reaffirms Axis Bank’s credit ratings. It has reaffirmed AAA (Stable) for Infrastructure Bonds/Debentures.

- Punjab National Bank (PNB) will not participate in capital raise plans of its housing finance subsidiary, PNB Housing Finance.

- Narayana Hrudayalaya gains after the company said its subsidiary, Health City Cayman Islands (HCCI) is expanding to a new location in the Camana Islands.

- Aarti Drugs winds up UAE-based subsidiary Pinnacle Life Science LLC.

- Muthoot Finance board has approved a proposal to raise Rs 6,000 crore by issuing non convertible debentures (NCDs).

- Karnataka Bank reports Rs 34.16-crore fraud against IL&FS Transportation to RBI.

- Amara Raja sets up research hub at its Tirupati facility to develop lithium-ion cells.

Important Global Cues:

- China has kept the one-year LPR (Loan Prime Rate) Unchanged at 3.85%. The five-year LPR remained at 4.65%. With this LPR rate, China has kept the benchmark loan rate steady for the ninth straight month. The LPR is a lending reference rate set monthly by 18 banks.

- The yields on 10-year bonds and 30-year bonds have risen 20 basis points and 22 basis points, respectively. This treasury yields rise amid concerns about the possibility of higher inflation.

- Bitcoin surges to all-time high of $56,620.

- European Markets decline at the opening bell.