Do you know which is the first Indian gaming company to go public?

Do you know which company had the third-largest IPO with an issue size of more than Rs 200 crore?

Do you know which company’s IPO was subscribed a whopping 175.5 times?

Do you know the one company which has the IP (Intellectual Property) rights for a range of domestic and international eSports?

The answer to all these questions is “Nazara Technologies Ltd.”. India’s first and leading diversified gaming and esports media platform company.

The company recently launched its IPO in March. It was one of the most awaited IPOs of 2021 due to two reasons. Firstly, Rakesh Jhunjhunwala, a renowned investor, had bought a major stake in the company. Secondly, this was India’s first online gaming company going public. Amazing! Isn’t it?

But, how did a gaming company reach this stage? Let’s dive deep into the backstory of the company. Don’t worry! This won’t be boring.

Understanding the Rise of Nazara Technologies

The year was 1995. 16-year-old Nitish Mittersain would bunk college and listen to Shammi Kapoor, who, at that time, happened to be the chairman of the Internet Users Association of India. They used to talk about how the internet could revolutionize the entertainment industry (a true prediction, right?).

Nitish acted on this discussion, not until 1999, when the internet users in India grew vast and internet games by Nintendo and Sony had pierced into it. He dreamed of and decided to set up a digital entertainment and gaming venture in India, years ahead of its time. Nitish Mittersain went to set up Nazara.com, new-age gaming, and entertainment website.

The tough times and roping in a legendary cricketer

Initially, he faced a setback due to the dot-com crash and found himself in a gigantic debt of Rs 3 crore. But, he did not let this crush his spirits to fulfill his dream and in 2004 he saw a remarkable opportunity to get back in business. He observed that feature phones were developing a trend in India, and came up with an idea to launch pay-per-download Java games in alliance with large telecom companies like BPL and Hutch. Nazara Technologies, being a versatile company and futuristic, decided to launch its first mobile games through Value Added Services (VAS) offering. Nazara hit a masterstroke when it roped in legendary cricketer Sachin Tendulkar as its brand ambassador for 3 years for just $ 10,000 when the latter demanded $ 1 million.

Funding that followed

In 2005, the company raised a seed round of $1.5 million, bringing in much-needed cash in its kitty. When feature phones became a necessity, the company decided to shift its focus to value-added services offering. In other words, Nazara partnered with mobile operators, which then billed their users for games consumed. The icing on the cake for telcos was that margins in gaming VAS were as high as 40% compared to other emerging spaces like music, ringtones, where it was around 5%. In 2006, the company signed M.S. Dhoni for an exclusive contract to represent their brand.

In 2008, EA Mobile, a subsidiary of the world’s largest game developer, Electronic Arts, wanted to launch mobile games in India. Nazara had existing tie-ups with telcos along with tech stack design to support game marketing, distribution, and reproduction, and thus, the two ended up signing an exclusive wireless content distribution agreement.

Soon, in 2009, it launched India’s first-ever subscription-based model ‘Games Club’ with RCom and Airtel. Games club started initially with 26 games and it was registered under Gclub.in. This allowed a large number of telecom users to play N number of games and to monetize their games.

On an Acquisition Spree:

Once Nazara realized that they had captured only a small part of the potential market, they quickly started to expand. They stretched their reach to Dubai, the Middle East, South East Asia, and Africa.

Nazara thought it beneficial to invest in ventures building for the gaming space and set up an INR 10 cr fund in 2013 for the same. Nazara’s first investment was in Hashcube. It also invested an undisclosed amount in London-based lifestyle game franchise TrulySocial. It acquired 26% in Mastermind Sports, a UK Based gaming company.

Nazara also launched a venture to help the gaming industry grow and soon started investing in other companies, even by partnering up with them. One of the major ventures was ‘HashCube’. These partnerships led to the introduction of some of the well-known games such as ‘Cut the Rope’, and to famous characters like Chhota Bheem, Amar Chitra Katha, etc.

| Sr No. | Name of Company | Year of Investment | Total Investment (Rs in Millions) | % Holding |

| 1 | Hashcube Inc. | 2014 | 22.00 | 12.38% |

| 2 | Mastermind Sports Limited | 2017 | 26.04 | 26.00% |

| 3 | Next Wave Multimedia Pvt Ltd | 2017 | 322.30 | 52.38% |

| 4 | Moong Labs Technologies Limited | 2017 | 10.00 | 24.41% |

| 5 | Nodwin Gaming Private Limited | 2018 | 767.68 | 54.99% |

| 6 | Instasportz Consultancy Private Limited | 2018 | 10.00 | 8.67% |

| 7 | Halaplay Technologies Private Limited | 2019 | 295.01 | 36.66% |

| 8 | Crimzoncode Technologies Private Limited | 2019 | 16.85 | 35.53% |

| 9 | Khichadi Technologies Private Limited | 2019 | 7.50 | 5.00% |

| 10 | Sports Unity Private Limited | 2019 | 55.90 | 63.63% |

| 11 | Absolute Sports Private Limited | 2019 | 438.42 | 63.90 % |

| 12 | Paper Boat apps Private Limited | 2019 | 200.10 | 15.06% |

Reliance Jio spoils the party

Things were going admiringly well for Nazara. The company was on the verge of launching an IPO in 2018 when a storm came in to shatter away its wish of an IPO. This storm was the one and only ‘Reliance Jio’. This new telecom was offering to provide free internet and other services to the customers. Nazara realized that with falling data costs and rising internet penetration, Indians might be unwilling to pay to play going forward. The promoters could see that this would mark the beginning of the end of the VAS era.

Nazara decided to shift back its focus to building a host of games loved by their audience. In January 2018, it acquired a majority stake in Nodwin gaming, a gaming solutions company that was also an e-sport event creator. In 2019, Nazara made an entry into Halaplay, a real-money fantasy game that competes with Dream11.

Nazara finally had its biggest breakout during the COVID19 lockdown with a noticeable 40% increase in people’s average screen time. This presented a wonderful opportunity for Nazara to increase their customer base with their products. The pandemic offered the company a boost with a gigantic increase, almost 20 times, in the daily active users. This was a major push they received and decided to finally fulfill its wish for an Initial Public Offer.

It was a roller coaster ride for Nazara, but they finally were able to launch their IPO this year in March, which was a great success.

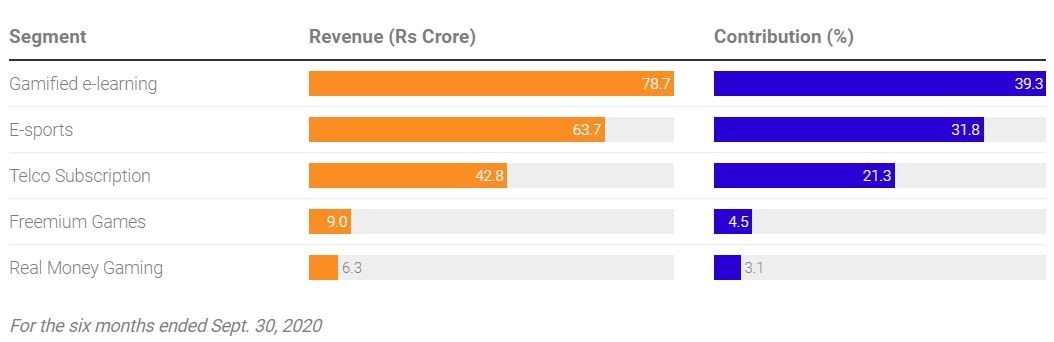

Nazara’s business verticals

Nazara Technologies had four major business verticals:

- Subscription: Under this model, the company tied up with telcos, who billed their customers for the gaming services they used. To address the low propensity to pay, the company offered daily, weekly and monthly subscriptions, and payment was collected by telcos, who then shared 50% of the revenues with service providers like Nazara.

- Freemium: Under this model, the company develops popular games, which can be downloaded by users through the play store for free. While playing these games, users would come across ads, which form a source of revenue for Nazara.

- Play and win: These are skill-based games where players compete against each other and win cash. The subscribers pay for playing these games.

- E-sports and competitive gaming: Under this model, the audience watches live-streaming of the match being played by professional players on OTT Platforms and listens to live commentary. Nazara has over 80% share in Indian markets through its majority stake in Nodwin.

Strengths

- Leadership position with a diversified portfolio

- Rise of the gaming industry

- Increasing penetration of smartphones

- A rise in Gen-Z population

- A rise in the number of online players in India

- High growth rate of the gaming industry

- Has an excellent distribution tie-up

- Intellectual Property rights

- Nazara owns recognizable brands such as Kiddopia, Sports Keeda and Nodwin gaming

- High repeat customer usage

- Has a trustworthy management

- Almost debt free

- Increased revenue

Weaknesses

- Fast-changing technology

- Fierce competition

- The increasing popularity of free-to-play and freemium games

- Stated losses in the previous financial year, around Rs 21 crore

- Low level of entry barriers in the industry

- Attraction to new competition

- Low promoter’s holdings, around 20 percent

- High price to book value ratio (6.7)

- Low ROE and ROCE

- Negative cash flows

- The company might not be able to monetize its eSports offerings

Also Read: How hard is it to double your money in the stock market?

Nazara Technologies Financial Snapshot

- The company reported a loss before tax of Rs 21 crores for the year ending FY20.

- The company witnessed an increase in monthly active users from 40.17 million in FY20 to an average of 57.54 million across all games for nine months ending 31st December’2020.

- The company has a presence across 64 countries spread across India, Africa, and the Middle East.

- The three-year average ROE (Return on Equity) was -1.3% and the three-year average ROCE (Return on Capital Employed) was 0.7%.

- The company has grown its revenues by 10.1% annually in the last 5 years.

- The company is debt-free and has cash and cash equivalents of more than 184 crores.

Some Qualitative factors

- The promoter stake in the company post-IPO will reduce to 20.7%.

- The management has a combined leadership of 16 years at the company.

- The promoter’s stake is free of any pledging.

- The company is free from any meaningful contingent liabilities.

- The company has very well-known brands such as Kiddopia, Sportskeeda, and Nodwin gaming.

Nazara’s Management Team

- Vikash Mittersain (Chairman & MD)

- Nitish Mittersain (Joint Managing Director)

- Sasha Mirchandani (Non-Executive, Independent Director)

- Shobha Jagtiani (Non-Executive, Independent Director)

- Probir Roy (Non-Executive, Independent Director)

- Rakesh Shah (Chief Financial Officer)

- Manish Agarwal (Chief Executive Officer)

- Pratibha Mishra (Company Secretary)

- Savio Saldanha (CEO Nazara Digital)

- Anshu Dhanuka (Co-Founder & CPO (Chief Product Officer) – Paper Boat)

- Anupam Dhanuka (Co-Founder & CEO – Paper Boat)

- Porush Jain (Sports Keeda Founder)

- Pratik Shah (CEO – Mastermindsports)

- Jayashree Poochi Ramaswamy (Co-founder & COO – Next Wave Multimedia Private Limited)

- Rajendran Poochi Ramasamy (co-founder & CEO – Next Wave Multimedia Private Limited)

- Akshat Rathee (Managing Director – NODWIN Gaming)

Nazara Technologies IPO details

| Issue dates | 17th March 2021 to 19th March 2021 |

| Face value per share | Rs 4 |

| Issue size | Rs 583 crore |

| Price band | Rs 1100 – 1101 |

| Minimum bid lot | 13 shares |

| Offer for sale (OFS) | 52.9 lakh shares |

| Listed on | NSE & BSE |

| Purpose of issue | Disinvestment of stake |

Reservation details are as follows:

| Qualified Institutional Buyers (QIB) | 75% |

| Non- institutional investors | 15% |

| Retail investors | 10% |

| Employees | up to Rs 2 crores (with a 10% discount) |

Other important parties involved in the IPO:

Promotor: Mitter Infotech LLP

Registrar: Link Intime India

Book Running Lead Managers: IIFL Securities, ICICI Securities, Nomura Financial Advisory and Securities, and Jefferies India

The company got a forward-looking and overwhelming response from the subscribers. This was quite evident with the number of applicants. The IPO was oversubscribed by a whacking 175.5 times. This was the result of the popular gaming solutions it had been catering to in India all these years. They provide premium products all the way from esports to mobile gaming and have managed to retain a high market share. In addition to this, deeper penetration of smartphones led to a rise in the gaming industry. Nazara Technologies has expanded to over 60 countries and the company’s revenue has grown at a CAGR of 20 percent over the 2018-2020 financial year.

Recommended: Top 10 Most Expensive Stocks in India

A seed that was sown more than 20 years ago is growing at the pace of climber. However, it’s easier said than done. Nazara has a lot on its table to turn it into their favor. They’ll have to understand and cope up with the gaming community, and will have to keep track of fast-changing technological developments. On the financial front, they will have to turn their cash flows positive and develop games and revenue pipelines that improve to become cash cows. Therefore, to make shareholders better off, a lot more needs to be done. But by making an early bet on online gaming, which bounced back from the shore of bankruptcy, Nazara Technologies has truly risen from the ranks to be the only listed gaming company on the Indian bourses!

Thank you and happy Investing!